A Generix e VISEO unem forças para simplificar a faturação eletrónica e acelerar a transformação digital dos seus clientes

A Generix tem o prazer de anunciar a sua parceria com a VISEO, uma empresa global de serviços de tecnologia…

Podcast Leroy Merlin & Generix: A nova capacidade logística da Leroy Merlin e os desafios da digitalização do consumidor. Pode ouvir aqui

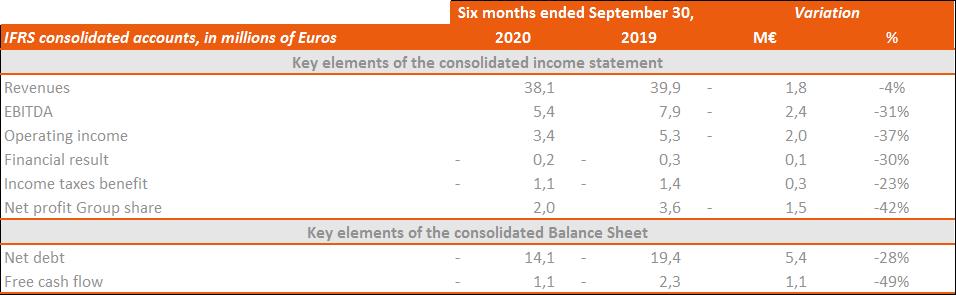

Under highly unusual economic and health circumstances, the resiliency of the Group’s business model has enabled recording a turnover of 38.1 million euros for the first half of the 2020-2021 fiscal year, with a limited decrease of 4%.

At the end of September 2020, Generix Group showed an EBITDA of 5.4 million euros, or an EBITDA margin of 14.3%. The 5.5-point decrease of EBITDA margin as compared to end September 2019 is almost entirely due (by 4.6 points) to additional investment in R&D decided on by the Group. In the context of the crisis, supply structures and intra-logistics resources are being stretched to the limit, resulting in a greater need for software and reinforcing the imperative of high-quality service at each link in the supply chain. The Group intends to take advantage of this situation to strengthen its position as a leader by quickly rounding out the offer and heightening operational excellence goals. Excluding growth in R&D investments, the drop in EBITDA margin was limited to 0.9 point, thanks to vigorous supervision of the cost structure that began in April 2020 to limit the impact of the health crisis.

The elements without an impact on cash flow showed a positive evolution, stemming mainly from an increase in the amount activated for software design expenses, and give a current operating result of 3.4 million euros, or 9% of turnover.

After taking into account non-recurring elements, the financial result and the tax effect, the net result is 2.1 million euros, as compared to 3.6 million euros for the first half of the previous fiscal year.

The cash flow statement indicates the flows between March 31 and September 30, 2020, as compared to the same period in the previous fiscal year. Between these two dates, working capital requirements increased because of the customary seasonal effect of annual maintenance contract invoicing (invoiced at the start of the calendar year and counted as revenue throughout the year).

Cash flows were marked by:

Generix Group anticipates a more dynamic SaaS contract signature rate for the second half of 2020/2021 as compared to the first half. This should enable a return to growth starting in the 2021/2022 fiscal year, after a 2020/2021 fiscal year showing a slight drop.

The crisis has revealed customer needs that the Group has decided to take charge of by reinforcing R&D efforts to maintain the competitive advantages of the Generix offer. In parallel, in the context of the health crisis, the Group is controlling the cost structure outside R&D expenses. On this basis, the evolution of profitability for the 2020/2021 fiscal year should be in line with that of the half just ended, with a controlled decrease in EBITDA margin, excluding the impact of R&D efforts.

Aceder ao documento

A Generix tem o prazer de anunciar a sua parceria com a VISEO, uma empresa global de serviços de tecnologia…

A Generix – uma empresa global que oferece uma ampla gama de soluções SaaS para a supply chain, finanças, comércio…

A Generix – empresa global de software para empresas que oferece uma ampla gama de soluções SaaS e serviços para…

Trabalhe com a nossa equipa para criar a sua pilha de software da cadeia de abastecimento ideal e adaptá-la às suas necessidades empresariais específicas.