A Generix e VISEO unem forças para simplificar a faturação eletrónica e acelerar a transformação digital dos seus clientes

A Generix tem o prazer de anunciar a sua parceria com a VISEO, uma empresa global de serviços de tecnologia…

Podcast Leroy Merlin & Generix: A nova capacidade logística da Leroy Merlin e os desafios da digitalização do consumidor. Pode ouvir aqui

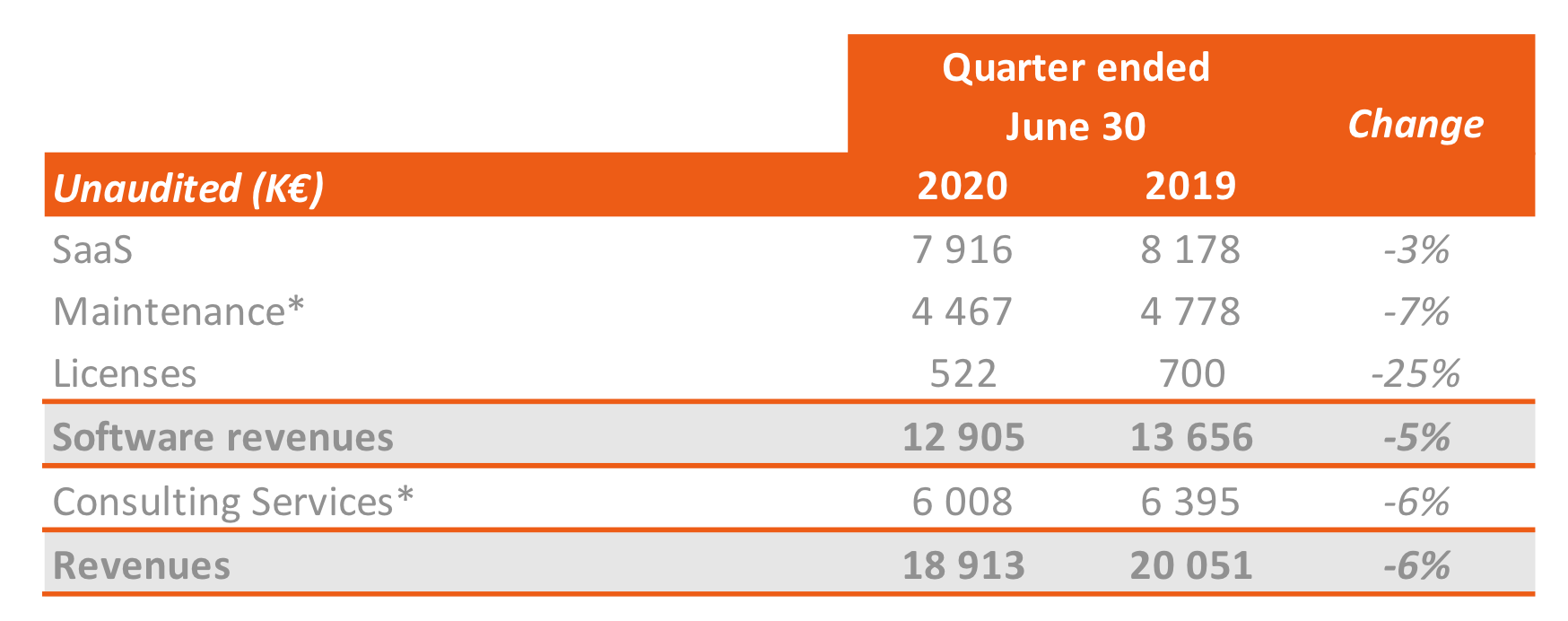

From the start of the lockdowns in Europe in mid-March, Generix Group showed its ability to quickly react and adapt by switching to teleworking in every country where it operates. Thanks to this organization which is still in place, the Group ensured that customers would retain levels of service, security and operational efficiency every bit as high as during normal times. The Group was able to innovate by completing a number of start-up remotely, even internationally, adding plenty of experience to capitalize on in the future. In the context of an unprecedented crisis where ensuring continued supplies of essential products was a core concern, the expertise and solutions brought by Generix Group were essential, earning renewed trust from customers. This is how Generix Group recorded sales of €18.9 M for the quarter, down only 6%.

Recurring business (SaaS + Maintenance) remained stable overall, with a slight fall in the use of existing SaaS contracts, made up for by growth thanks to new contract signings. The level of use of installed solutions remained strong, confirming the position held by the Group’s solutions at the heart of customer’s operational systems as well as the model’s resilience.

Over the quarter, France, thanks to its installed base, and North America, where there were growth reserves, were the main areas that contributed to license revenues that came to €0.5 M.

Lastly, services—by their very nature more exposed in a context like this one—fell by a limited 6% (down 10% excluding reclassifications) given business levels that were practically normal in North America, Russia, Portugal and the Benelux, despite lockdowns in each of these countries.

Customers continued to sign new SaaS contracts, despite a tendency to sit on the fence, and this brought in a total of €0.5 M.

The quarter also stood out with the signature of a new (On Premise) maintenance contract with a major French retailer that will in the future generate additional maintenance revenues of €0.6 M.

The commitment of the sales teams who remained mobilized throughout this period should be commended.

The levels of income and contract signatures observed during the past quarter mean that Generix Group can confirm their forecast for 2020/2021 business levels that are close to those of 2019/2020, assuming that economic activity levels return to normal from September 2020.

To prepare and support a dynamic return to growth, Generix Group has chosen to not change its operational response and to increase its effort in innovation.

The Group has decided to invest in R&D during the coming months to develop new components of its offer that respond to current issues facing customers, including the emergence of new uses around robotization, automation, enhanced reality and the IOT.

On this basis, the Group anticipates a managed fall back in Ebitda during the current financial year and a return to growth levels comparable to those of the last financial years as of 2021/2022, assuming a stabilized health context.

The crisis provided insight into the crucial challenges affecting the supply chain and corporate requirements in terms of dematerialization. Generix Group, an expert in managing critical flows both physical and dematerialized, confirms its ambition to become a key player in these markets.

With a resilient model, a healthy financial structure and strong recurring income, the Group has confidence in the future and is as of now ready for a rebound.

Supplemental and non-IFRS Financial Information

Supplemental non-IFRS information (above-mentioned as EBITDA) presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies.

Aceder ao documento

A Generix tem o prazer de anunciar a sua parceria com a VISEO, uma empresa global de serviços de tecnologia…

A Generix – uma empresa global que oferece uma ampla gama de soluções SaaS para a supply chain, finanças, comércio…

A Generix – empresa global de software para empresas que oferece uma ampla gama de soluções SaaS e serviços para…

Trabalhe com a nossa equipa para criar a sua pilha de software da cadeia de abastecimento ideal e adaptá-la às suas necessidades empresariais específicas.