Generix anuncia a nomeação de Laurent De Kimpe para o cargo de Diretor Financeiro

Paris, FRANÇA, 9 de setembro de 2025 – A Generix, empresa internacional de software de gestão que oferece um vasto…

Generix renova a sua Certificação ISO 27001. Saiba mais

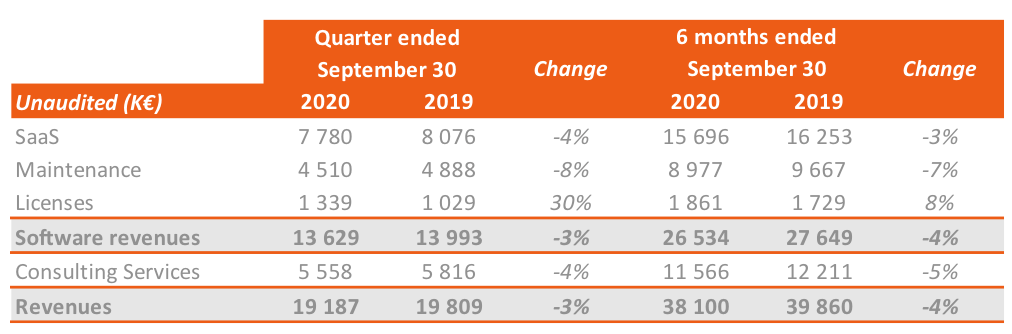

The second quarter unfolded in a continuously demanding economic and health climate. However, our customers’ confidence in our ability to support them over the long term has allowed the Group to record turnover of €19.2 M, with a decrease limited to 3%.

SaaS activities, which were slightly down, showed a drop in customary over-consumption. Contractual commitments have remained at their normal level.

License sales have grown by 30%. They were driven by a dynamic North American market, where licenses are the norm, with a threefold increase in signatures as compared to the same quarter of the previous fiscal year.

Our existing and prospective clients continued to sign new SaaS contracts amounting to €0.6 M, close to the amount recorded in the same quarter of the previous fiscal year.

The level of revenue and signatures for the quarter is in line with Group expectations in the context of the pandemic. The hypothesis of a gradual return to normal economic activity starting from September 2020 has not yet materialized and leads the Group to anticipate a slight drop in revenue for the 2020/2021 fiscal year.

Work on cost structure suggests a controlled decrease in EBITDA margin, without including the impact of funding for Research and Development. This effort is part of the perspective to support expected growth in subsequent fiscal years.

With a healthy financial situation and better cash flow than this time last year, the Group confirms its strategy of consolidating activity in Europe and developing activity in North America.

Supplemental non-IFRS information (above-mentioned as EBITDA) presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies.

Aceder ao documento

Paris, FRANÇA, 9 de setembro de 2025 – A Generix, empresa internacional de software de gestão que oferece um vasto…

Generix anuncia a disponibilização de schematrons para faturação eletrónica, desenvolvidos pelas suas equipas de Investigação e Desenvolvimento (I&D), com o…

A Generix Group, editor de soluções colaborativas SaaS para o ecossistema da Supply Chain, Indústria e Retalho, renova a Certificação…

Trabalhe com a nossa equipa para criar a sua pilha de software da cadeia de abastecimento ideal e adaptá-la às suas necessidades empresariais específicas.